The Reality of Average Household Income in Winnipeg: Statistics, Challenges, and Future Outlook

Key Insights

| CareerBeacon highlights that the city’s average annual salary is $50,120, which is 8% lower than the national average of $54,450. Statista reports that the average household income in Canada is $98,830, while Manitoba’s is $90,880.According to the Government of Winnipeg’s 2021 Census, the median household income for all family types in Winnipeg was $77,000. A City of Winnipeg report shows that visible minorities made up 31.5% of Winnipeg’s population in 2021. The same report reveals that 12.4% of Winnipeg’s population identified as indigenous in 2021, which represents 91,000 individuals. |

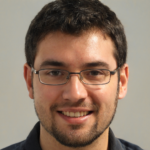

CareerBeacon indicates that income levels in Winnipeg are an important determining factor in the financial well-being of its inhabitants. The city’s average annual salary is $50,120, an 8% decrease compared to the national average of $54,450.

In addition to this, the city’s mean household earnings in 2020 stood at $50,120. This is an indication that most families have multiple earners to sustain a good living level.

However, a typical Winnipeg resident’s monthly net earning is about $4,176. This is barely greater than Winnipeg’s monthly living expense of $3,313 for a single tenant.

This modest margin leaves hardly any room for discretionary spending or unanticipated charges. For individuals who earn higher incomes, the economic situation is much better.

Thus, dual-income households or professionals making higher wages are more likely to be able to cover costs and save for long-term financial objectives.

Meanwhile, a family with an annual income of $100,000 has a net income of $70,834 after taxes, which works out to a monthly net income of $5,903.

With the average cost of living being $3,313, these families have more room in their budget for savings, investments, or spending capacity.

While Winnipeg is still one of the more budget-friendly cities in Canada, those making nearer the city’s average wage might find themselves struggling to make ends meet.

| Category | Amount |

| Average Salary (Annual) | $50,120 |

| Average Household Income (2020) | $50,120 |

| Monthly Net Income (at $50,120/year) | $4,176 |

| Annual Net Income (at $100,000/year) | $70,834 |

| Monthly Net Income (at $100,000/year) | $5,903 |

| Monthly Cost of Living (Single Renter) | $3,313 |

Median Household Income Across Canadian Provinces

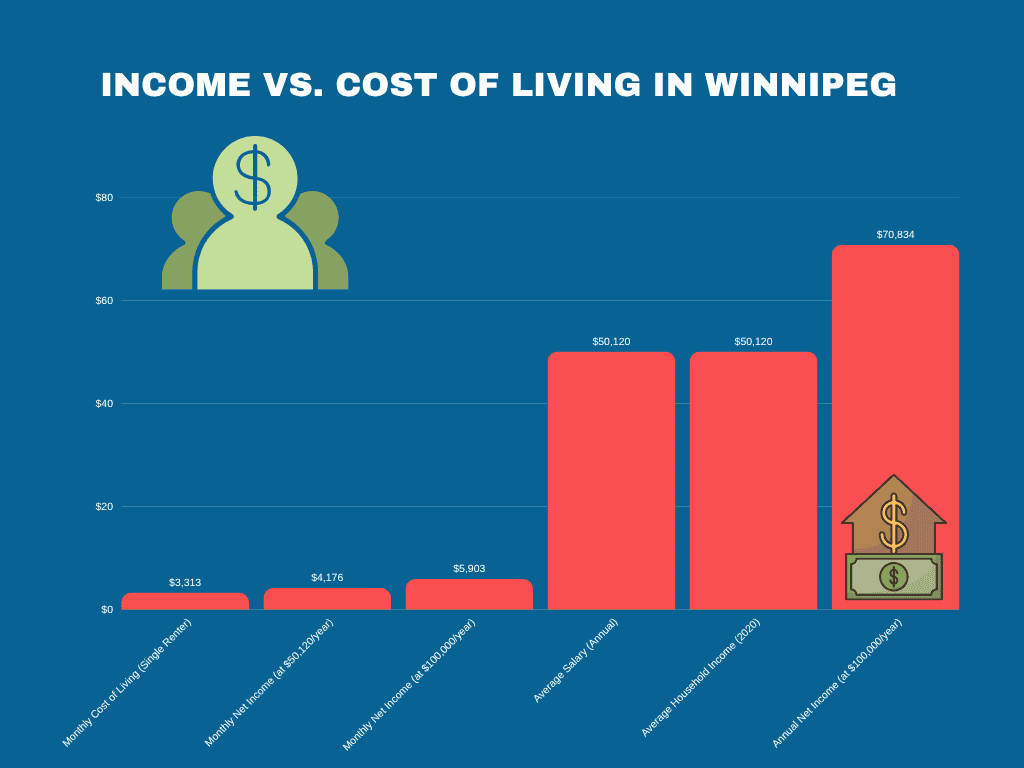

Household earnings differ considerably throughout Canada, with some provinces and regions showing much higher incomes than others.

According to Statista, the average household income in Canada is $98,390, though there are considerable regional variations.

The Northwest Territories lead this trend with a median of $134,610, followed by Yukon at $125,790 and Alberta at $106,960. These are mostly caused by healthier labor markets, better wages, and stronger natural resource economies.

Conversely, some provinces are below the national median. Manitoba has a median income of $90,880, which is below the national median of $98,390.

However, it is also above other areas, such as Prince Edward Island ($90,220), Newfoundland and Labrador ($89,530), and New Brunswick ($85,150).

Meanwhile, Nunavut has the lowest median income at $82,490, reflecting more economic difficulties.

Overall, the information shows the large income disparity between regions in Canada, with western provinces and northern territories tending to have higher median incomes.

| Province/Territory | Median Income (CAD) | Comparison to National Median ($98,390) |

| Canada (National Median) | $98,390 | Baseline |

| Northwest Territories | $134,610 | ↑ $36,220 |

| Yukon | $125,790 | ↑ $27,400 |

| Alberta | $106,960 | ↑ $8,570 |

| British Columbia | $99,610 | ↑ $1,220 |

| Ontario | $99,550 | ↑ $1,160 |

| Quebec | $96,910 | ↓ $1,480 |

| Saskatchewan | $96,770 | ↓ $1,620 |

| Manitoba | $90,880 | ↓ $7,510 |

| Prince Edward Island | $90,220 | ↓ $8,170 |

| Newfoundland and Labrador | $89,530 | ↓ $8,860 |

| Nova Scotia | $87,540 | ↓ $10,850 |

| New Brunswick | $85,150 | ↓ $13,240 |

| Nunavut | $82,490 | ↓ $15,900 |

Household Income Trends in Winnipeg

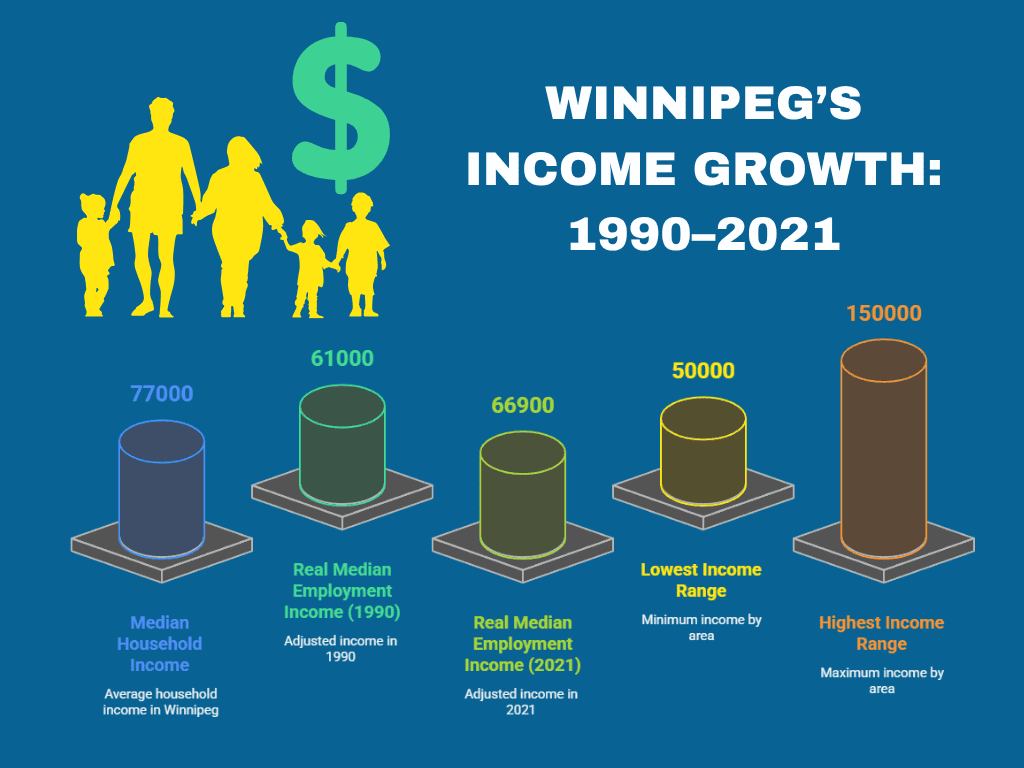

Winnipeg’s median household income has seen considerable expansion over the last thirty years.

The median household income for all types of census families in the Winnipeg Census Metropolitan Area (CMA) was $77,000, as reported by the Government of Winnipeg’s 2021 Census.

This is a considerable rise compared to previous years, indicating overall economic growth and inflation-adjusted pay rises. A closer look at real median employment income shows a gradual upward trend.

In 1990, the real median employment income was $61,000, which rose to $66,900 in 2021. This marks a stark 9.7% increase over 31 years, suggesting steady improvements in wage levels despite economic fluctuations.

Moreover, the distribution of income in Winnipeg is highly diverse in each neighborhood. This shows that some median household incomes are over $150,000, while others are below $50,000.

| Category | Amount (CAD) | Change Over Time |

| Median Household Income (Winnipeg CMA) | $77,000 | – |

| Real Median Employment Income (1990) | $61,000 | – |

| Real Median Employment Income (2021) | $66,900 | ↑ 9.7% (31 years) |

| Lowest Income Range (by Area) | < $50,000 | – |

| Highest Income Range (by Area) | $150,000+ | – |

Demographic Breakdown in Winnipeg

A report made by the City of Winnipeg Government reported that the population of Winnipeg has witnessed dramatic developments in recent history as a result of international migration, growing diversity, and a robust Indigenous population.

Based on the 2021 Census, the total enumerated population of the city stood at 749,607.

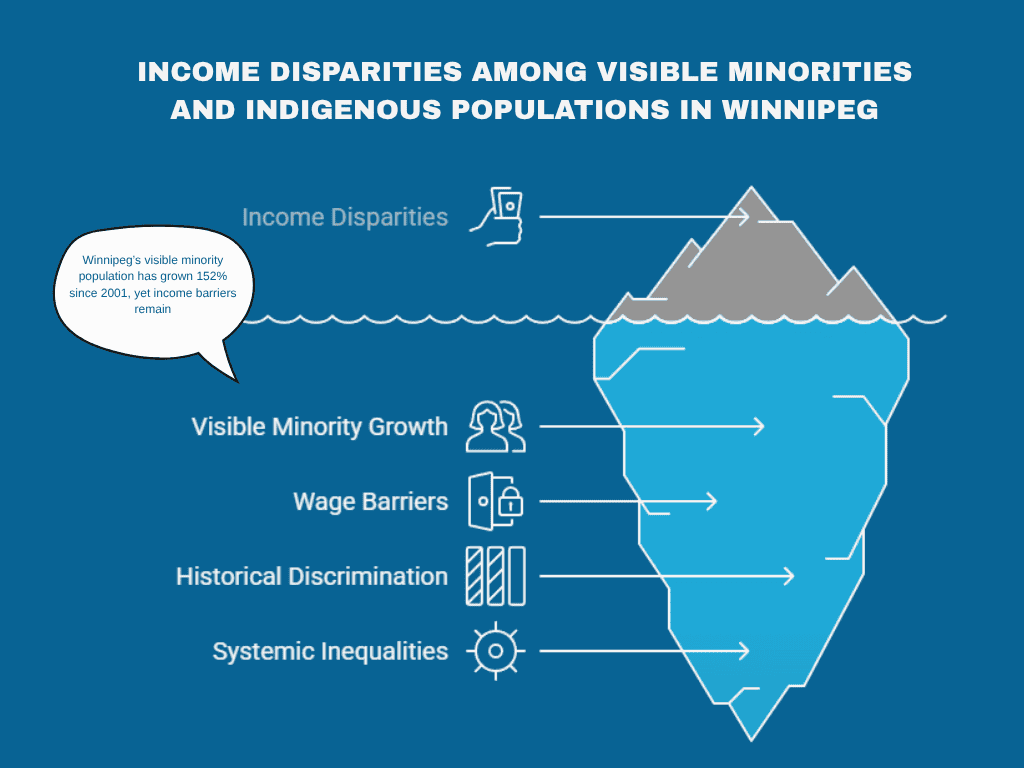

Visible Minorities in Winnipeg

Winnipeg’s increasing diversity has had a significant impact on household income trends, particularly as visible minority groups make up a growing share of the city’s workforce.

In 2021, visible minorities accounted for 31.5% of Winnipeg’s population, a 152% increase from 12.5% in 2001. The total number of visible minority residents reached 258,190.

Among these groups, the Filipino population grew to 84,225, accounting for 32% of all visible minorities.

The South Asian community increased to 63,810, making up 25%, while the Black population reached 40,925, reflecting a 16% share.

Meanwhile, Chinese residents numbered 23,030, representing 9% of the population. Other visible minority groups made up 46,200, accounting for another 18%.

As migrants integrate into the labor market, household income levels can vary widely, influenced by employment opportunities, industry participation, and wage gaps.

Statistics Canada reports that rising low-income rates among recent immigrants, when compared to Canadian-born citizens, have become a cause for concern as immigrants have not seen an increase in relative economic performance.

While many visible minority groups contribute to Winnipeg’s growing labor force, barriers such as credential recognition, occupational segregation, and lower starting wages can impact earning potential.

Indigenous Populations in Winnipeg

Indigenous identity plays a significant role in Winnipeg’s demographic and economic landscape, influencing household income levels and access to financial resources.

In 2021, 12.4% of Winnipeg’s population identified as Indigenous, totaling 91,000 individuals.

The majority belong to two main groups, with Métis individuals making up 53% of the Indigenous population at 47,915, and First Nations residents accounting for 44% at 40,290.

Other Indigenous identities, including Inuit, represent 3% or 2,340 individuals.

Income disparities remain a challenge for many Indigenous households, as factors such as employment barriers, historical economic exclusion, and gaps in educational attainment affect earning potential.

While government initiatives aim to address these disparities, Statistics Canada shows that Indigenous families in Winnipeg still experience lower median household incomes compared to non-Indigenous residents.

For example, the data showed that only 44.09% of First Nation males and 52.26% of females in low-income households completed high school, compared to 68.21% of males and 75.67% of females from non-low-income households.

As higher education is closely linked to improved income opportunities, these disparities contribute to lower median household incomes among Indigenous communities in Winnipeg.

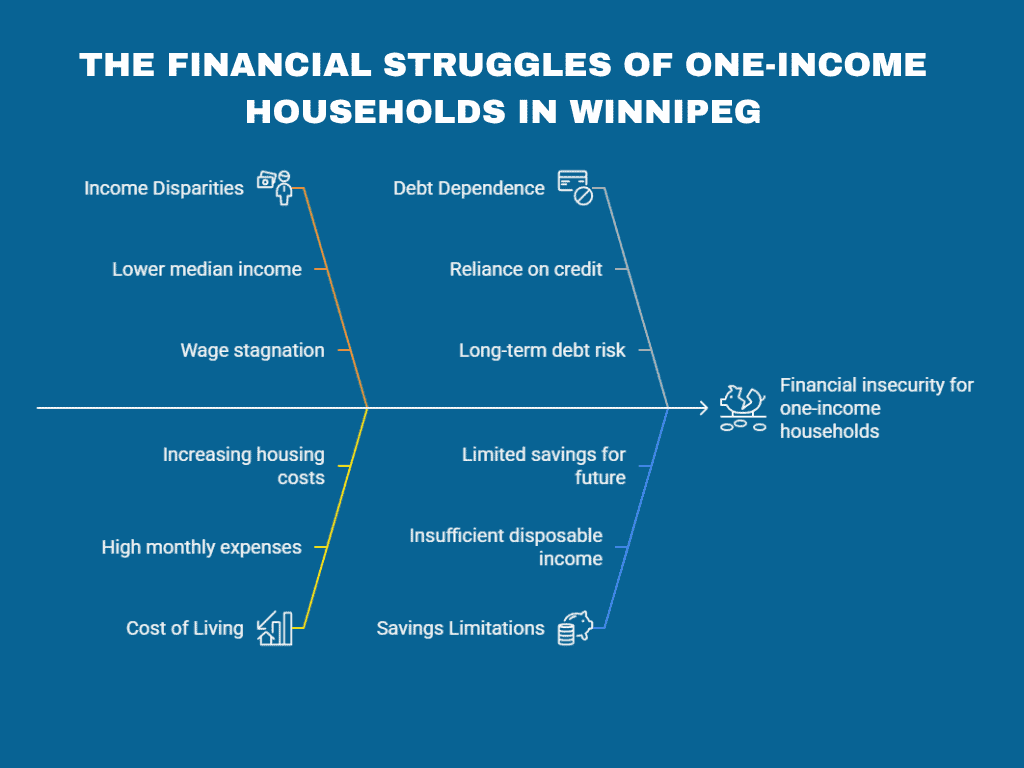

Costs and Consequences of Income Disparities in Winnipeg

While Winnipeg is thought of as one of the cheaper cities in Canada, CareerBeacon reports a more complex picture regarding income levels and the cost of living.

One-income households are among the most impacted by Winnipeg income gaps.

The city’s median income is $50,120 annually, which is 8% less than the Canadian median of $54,450.

Meanwhile, the average monthly cost of living for a single renter is $3,313, covering housing, transportation, food, and other essentials.

On a $50,120 annual salary, a single earner’s estimated take-home pay would be $4,176 each month, which does not leave much financial space for anything other than necessities.

Lacking sufficient disposable income, numerous one-income families depend on credit for unforeseen expenses. This runs the risk of subjecting them to long-term debt.

Moreover, higher rent and housing prices further restrict their capacity to save for home ownership or retirement, causing many to focus on short-term survival rather than financial development.

As the cost of living continues to increase, economic security comes to rely more on family income than on single wages.

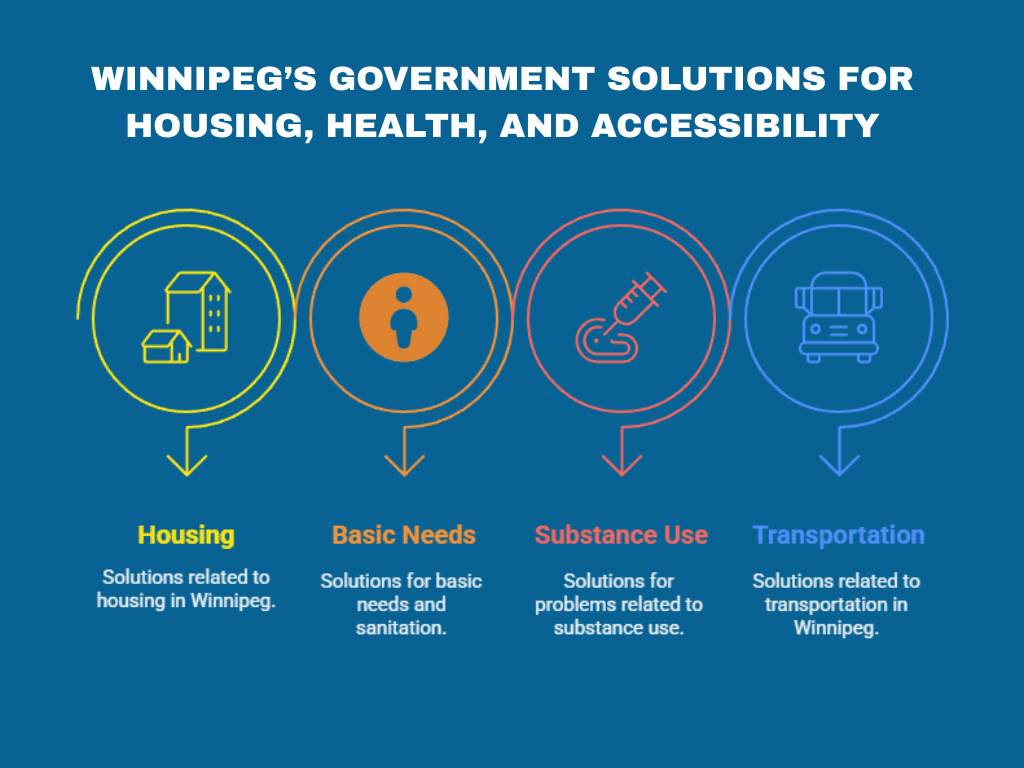

Interventions and Solutions to Income Disparities in Winnipeg

The Winnipeg government has pursued a multi-faceted strategy for housing affordability, basic needs, transportation access, and community well-being.

Through strategic policy and focused programs, the city seeks to enhance the living situation of low-income residents, assist vulnerable groups, and foster inclusive urban development.

These interventions are coordinated with long-term goals, prioritizing affordable housing, basic services, substance use reduction, and equitable neighborhood planning.

One of the key initiatives of the city is the Affordable Housing Strategy, which involves the creation of a city-wide Affordable Housing Action Plan and a revised Housing Needs Assessment.

These initiatives seek to monitor and fill housing supply gaps, including social and accessible housing, rental assistance, and transitional housing for the homeless.

Projects like the Housing Accelerator Fund are being used to scale deeply affordable rentals, aid newcomer and Indigenous families, and keep existing low-income housing.

Substance use is another priority area. Winnipeg continues to roll out the Naloxone Protocol in public facilities such as recreation centers and libraries, making emergency overdose prevention services readily accessible.

The city is also working with community organizations to place sharps disposal containers in parks, making public spaces safer and minimizing harm associated with substance use.

Transportation access is also a key area of emphasis. The government is making efforts to enhance transit facilities through improved snow clearing for secure winter travel, increased pedestrian-friendly sidewalks, and greater transit access for individuals with disabilities.

These initiatives are intended to provide low-income communities with dependable, affordable transportation to work, school, and necessary services.

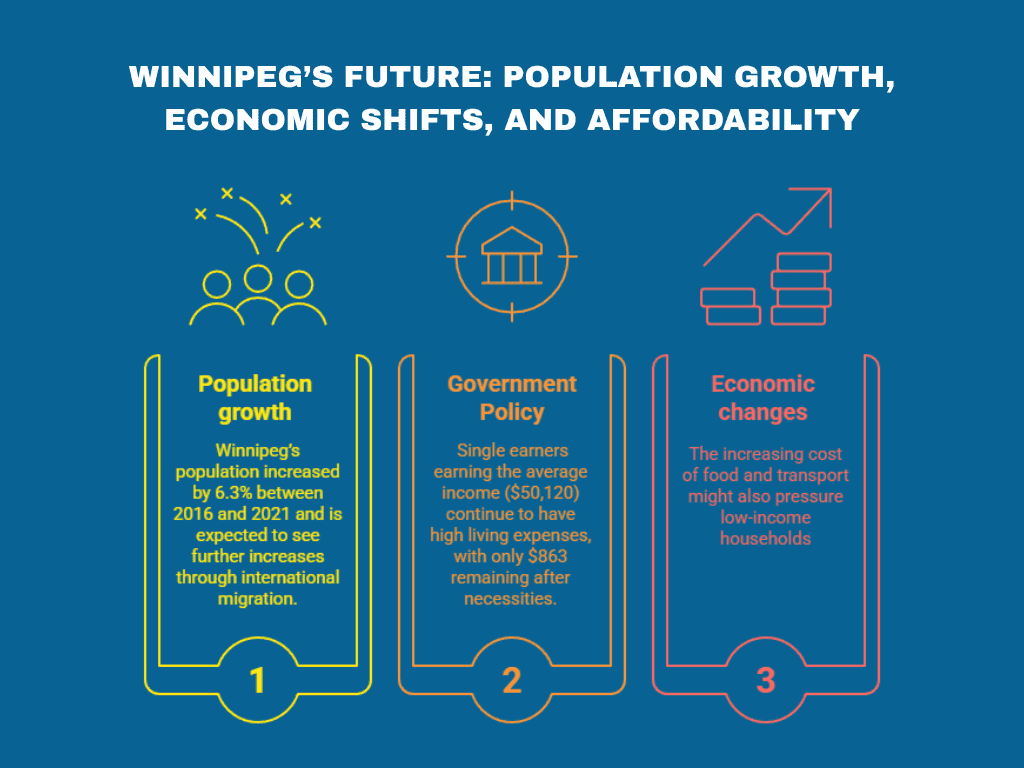

The Future of Household Incomes in Winnipeg

Winnipeg’s economic and social situation is likely to change as a result of population growth, policy, and economic changes.

Winnipeg’s population increased by 6.3% between 2016 and 2021 and is expected to see further increases through international migration.

Meanwhile, the increasing visible minority population (31.5% in 2021, a rise from 12.5% in 2001) indicates Winnipeg is going to get even more diversified, with the Filipino, South Asian, and Black communities growing.

Despite economic difficulties, government policies are likely to stabilize affordability. For example, the living wage has fallen to $18.75/hour in 2024 as a result of higher government assistance through childcare subsidies, tax relief, and income support.

However, despite efforts from the government, financial inequality will remain. Single earners earning the average income ($50,120) continue to have high living expenses, with only $863 remaining after necessities.

The increasing cost of food and transport might also pressure low-income households further, even as tax relief actions begin to counteract some of this pressure.

Winnipeg’s future will be largely determined by population increase, affordability issues, and increasing social policies.

As increased costs continue to be an issue, government assistance and investment in infrastructure are expected to help sustain economic stability for citizens.

References

- CareerBeacon. (n.d.). Cost of living in Winnipeg, Manitoba on a $100,000 salary. Retrieved March 9, 2025, from https://www.careerbeacon.com/en/cost-of-living/winnipeg_manitoba/100000-salary

- Statista. (n.d.). Median annual family income in Canada, by province. Retrieved March 9, 2025, from https://www.statista.com/statistics/467078/median-annual-family-income-in-canada-by-province/

- City of Winnipeg. (2023). Economic, demographic, and fiscal outlook 2023. Retrieved from https://legacy.winnipeg.ca/cao/pdfs/2023-Economic-Demographic-and-Fiscal-Outlook.pdf

- City of Winnipeg. (2024). Public restroom strategy implementation plan (2024–2027). Retrieved from https://ehq-production-canada.s3.ca-central-1.amazonaws.com/18a6115d2c75accd3e9407f8ee81fb30ccfa7846/original/1718889647/742e69c01f14b6a07337277d400a54f8_PRS_Implementation_Plan_2024-2027_-_FINAL.pdf

- Statistics Canada. (2023). Education indicators in Canada: Fact sheets. Retrieved from https://www150.statcan.gc.ca/n1/pub/81-599-x/81-599-x2023001-eng.htm

- City of Winnipeg. (n.d.). Affordable housing now. Retrieved March 9, 2025, from https://www.winnipeg.ca/building-development/housing/affordable-housing-now

- Government of Manitoba. (n.d.). Naloxone program. Retrieved March 9, 2025, from https://www.manitoba.ca/health/publichealth/naloxone.html

- Canada Mortgage and Housing Corporation. (n.d.). Housing Accelerator Fund. https://www.cmhc-schl.gc.ca/professionals/project-funding-and-mortgage-financing/funding-programs/all-funding-programs/housing-accelerator-fund