The Winnipeg Real Estate Market: Statistics, Affordability, and Future Projections

Key Insights

| Statistics from the Winnipeg Housing Market show that the average home price in the city was $357,708, 0.3% higher than that in January 2024. The same report further indicated that as a whole, Winnipeg’s current inventory of real estate holds 2,597 properties, which include 1,077 detached homes, 303 condos, and 194 townhomes. Statistics Canada data shows that Winnipeg’s real estate market remains one of the most affordable in Canada’s major cities, with a current average home price of $357,708. The Winnipeg Regional Real Estate Board reveals that the Downtown sector had no sales of detached or attached homes, which is a continuation of the slowdown in these categories of property. The Winnipeg Street Census illustrates that Homelessness remains a significant issue in Winnipeg, with a minimum of 1,256 individuals without a home. |

Data from the Winnipeg Housing Market reveals that Winnipeg’s real estate market in January 2025 was a combination of weakening short-term price trends and stable long-term trends.

The city’s average home price was $357,708, up 0.3% from January 2024 but down 2.7% from last month. The volume of home transactions was 722, up 9.9% from the same period last year but down 2.7% from last month.

Detached houses continued to be the priciest type of property, with an average sale price of $413,247, a 4.1% rise from January 2024 but a 2.5% fall from December 2024.

In total, 447 detached houses were sold during this period. This is a 34% drop from the last month but still 0.9% above last year’s numbers.

Meanwhile, attached homes experienced the most dramatic price reduction, with a median sale price of $356,058, a 9.0% decrease from the previous year and a 7.5% drop from December 2024.

Even at reduced prices, 60 attached homes were sold. This is a decrease of 14.3% from the prior month but an increase of 22.4% from last year, which shows increasing demand for this type of property.

Similarly, condominium prices also fell, with the average sale price decreasing to $249,793. This is a 10.4% fall from January 2024 and an 8.4% decline from December.

111 condo units were sold, which is 7.5% less than the last month but 12.1% more than in January 2024.

Overall, Winnipeg’s current real estate inventory contains 2,597 properties, comprising 1,077 detached houses, 303 condos, and 194 townhomes. This is a 14% drop in listings from a year ago but still slightly higher than the five-year average inventory.

| Property Type | Avg. Sold Price | 1-Month Change | 12-Month Change | Transactions (Buy/Sell) | 1-Month Sales Change | 12-Month Sales Change |

| Residential Properties | $357,708 | -2.7% | +0.3% | 722 | -2.7% | +9.9% |

| Detached Homes | $413,247 | -2.5% | +4.1% | 447 | -3.4% | +0.9% |

| Attached Homes | $356,058 | -7.5% | -9.0% | 60 | -14.3% | +22.4% |

| Condo Apartments | $249,793 | -8.4% | -10.4% | 111 | -7.5% | +12.1% |

Regional Analysis of Housing Prices Across Canada

Data from Statistics Canada reveals that Winnipeg’s real estate market is still one of the most affordable among Canada’s major cities, with a current average home price of $357,708 as of January 2025.

This price is also significantly below the national average of $698,500.

In comparison to other large markets such as Toronto ($1,040,994) and Vancouver ($1,208,415), Winnipeg housing is still more affordable.

Among Prairie cities, Edmonton’s $438,278 average home price is still higher than Winnipeg’s, but Calgary is Alberta’s leader with a $605,026 average.

Saskatchewan’s market is still more affordable, with lower prices in cities such as Regina and Saskatoon at $310,521.

Within Central Canada, cities such as Ottawa ($670,258) and Montreal ($619,874) reflect noticeably more costly properties. Hamilton ($757,071) and London ($639,486) similarly have higher-cost housing markets.

The home prices in Atlantic provinces are also climbing, with Halifax recording a mean of $575,907.

| City | Avg. Home Price |

| Vancouver | $1,208,415 |

| Toronto | $1,040,994 |

| Hamilton | $757,071 |

| Ottawa | $670,258 |

| Montreal | $619,874 |

| Calgary | $605,026 |

| Halifax | $575,907 |

| London | $539,486 |

| Edmonton | $438,278 |

| Winnipeg | $357,708 |

| Regina | $310,521 |

| National Average | $698,500 |

City-Level House Pricing Trends in Winnipeg

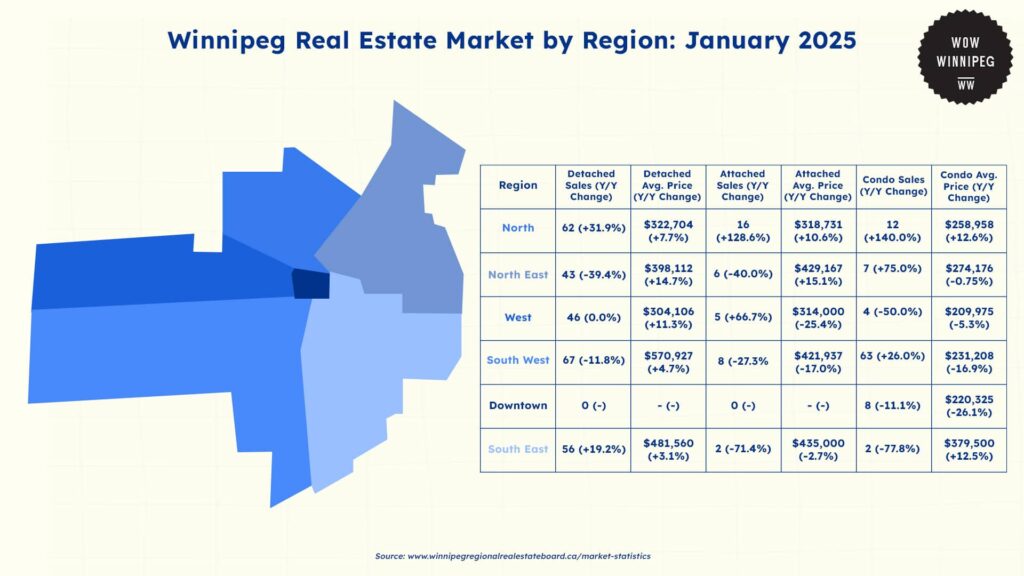

The Winnipeg Regional Real Estate Board shows that Winnipeg housing market trends are diverse, based on data from January 2025.

| Region | Detached Sales (Y/Y Change) | Detached Avg. Price (Y/Y Change) | Attached Sales (Y/Y Change) | Attached Avg. Price (Y/Y Change) | Condo Sales (Y/Y Change) | Condo Avg. Price (Y/Y Change) |

| North | 62 (+31.9%) | $322,704 (+7.7%) | 16 (+128.6%) | $318,731 (+10.6%) | 12 (+140.0%) | $258,958 (+12.6%) |

| North East | 43 (-39.4%) | $398,112 (+14.7%) | 6 (-40.0%) | $429,167 (+15.1%) | 7 (+75.0%) | $274,176 (-0.75%) |

| West | 46 (0.0%) | $304,106 (+11.3%) | 5 (+66.7%) | $314,000 (-25.4%) | 4 (-50.0%) | $209,975 (-5.3%) |

| South West | 67 (-11.8%) | $570,927 (+4.7%) | 8 (-27.3%) | $421,937 (-17.0%) | 63 (+26.0%) | $231,208 (-16.9%) |

| Downtown | 0 (-) | – (-) | 0 (-) | – (-) | 8 (-11.1%) | $220,325 (-26.1%) |

| South East | 56 (+19.2%) | $481,560 (+3.1%) | 2 (-71.4%) | $435,000 (-2.7%) | 2 (-77.8%) | $379,500 (+12.5%) |

North Winnipeg

Detached house sales hit 62 transactions, which is a 31.9% year-on-year growth. The average detached house price hit $322,704, representing a 7.7% growth from January 2024.

Meanwhile, residential attached house sales jumped, with 16 houses sold, representing a 128.6% year-on-year growth. The average attached house price hit $318,731, representing a 10.6% yearly growth.

The condominium sector also grew considerably. Condo sales rose by 140.0% compared to last year, at 12 units sold. Prices caught up as well, with the average condo price increasing to $258,958, a 12.6% increase from last year.

North East Winnipeg

The North East area saw a drop in detached home sales, with 43 homes sold, a 39.4% decrease from last year. However, the average detached home price rose to $398,112, a 14.7% rise from last year.

Residential attached home sales fell as well, with six homes sold – a 40.0% fall from last year. Still, the average attached home price rose to $429,167, a 15.1% rise from January 2024.

Condominiums experienced favorable sales growth, as seven condo units were sold – up 75.0% year over year. Yet, the average condo price decreased marginally to $274,176, down 0.75% from last year.

West Winnipeg

The West area recorded 46 detached home sales, registering zero year-over-year change, as demand remained stable. The average detached home price increased to $304,106, up 11.3% from last year.

On the other hand, attached home sales rose, with five houses sold, which is a 66.7% increase compared to last year. The average price of an attached home, however, fell to $314,000, a 25.4% decrease from last year.

The condominium sector in the West experienced the steepest fall, with four units sold, a 50.0% fall in sales from January 2024. The average condo price also fell to $209,975, down by 5.3% from last year.

Downtown Winnipeg

The Downtown area reported no sales of detached or attached houses, reflecting an ongoing slowdown in these segments of property.

The condominium sector did see some activity, with eight condos sold, an 11.1% year-over-year decline. The average condo price also dropped considerably to $220,325, a 26.1% slump from last year, the steepest price drop of any sector.

South East Winnipeg

The South East area had 56 detached home sales, a 19.2% year-over-year increase. The average detached home price was $481,560, a 3.1% year-over-year rise.

Residential attached home sales dropped significantly, with just two transactions – a 71.4% year-over-year decrease. The average attached home price dropped to $435,000, a 2.7% decrease from January 2024.

The South East condominium market experienced one of the steepest drops, with a mere two condo units sold, representing a 77.8% drop from last year. The average condo price, however, rose to $379,500, representing a 12.5% increase from last year.

South West Winnipeg

The South West area saw 67 detached home sales, down by 11.8% from year-to-year sales. However, the average price of detached homes increased to $570,927, a 4.7% increase compared to January 2024.

Attached home residential sales decreased with eight homes sold, decreasing by 27.3% from last year. Prices also went down, with the average attached home price down to $421,937, down by 17.0% from the previous year.

Condo sales were the only segment to increase, with 63 units sold, a 26.0% year-over-year increase. Notably, the average condo price fell to $231,208, down 16.9% from January 2024.

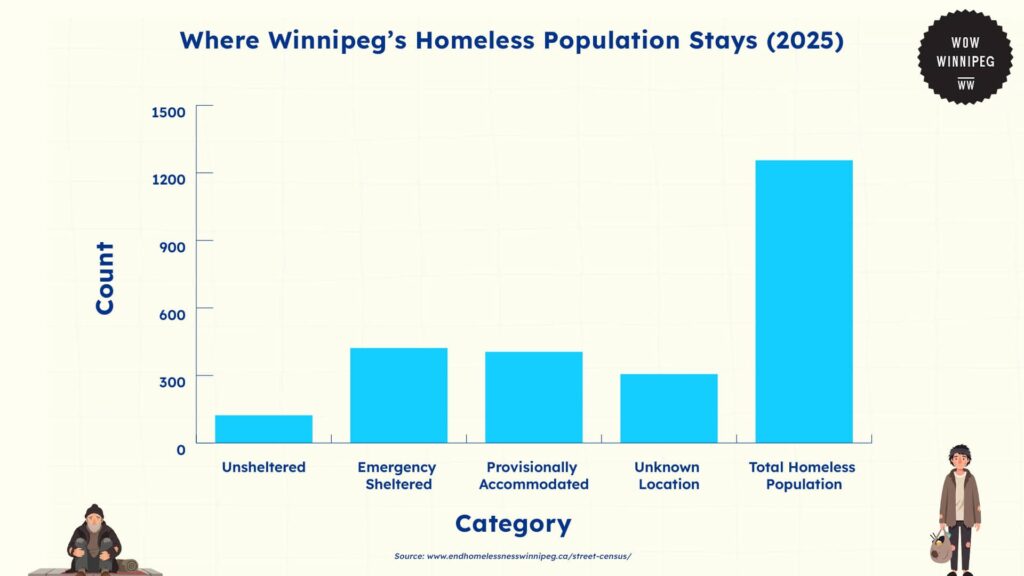

Homeless Demographic in Winnipeg

The Winnipeg Street Census reveals that Homelessness is still a major problem in Winnipeg, with at least 1,256 people without a place to call home.

Of these, 123 individuals are unsheltered, being in public places, and 422 people are staying in emergency shelters.

Another 405 are in temporary housing, including transitional housing, hotels, or residing with relatives and friends, and 306 people have no known location.

The increasing housing cost remains a significant obstacle to finding stable housing. In January 2025, the Winnipeg average home price hit $357,708, rendering homeownership more and more out of reach for lower-income earners.

Most homeless individuals report low income, high cost of living, and limited affordable housing choices as major factors contributing to their housing instability.

| Category | Count |

| Unsheltered | 123 |

| Emergency Sheltered | 422 |

| Provisionally Accommodated | 405 |

| Unknown Location | 306 |

| Total Homeless Population | 1,256 |

Costs and Consequences of High Housing Costs

The Financial Post reports on how increased housing costs in Canada have far-reaching effects on the local economy and the quality of life for residents.

When property values rise, prices become less affordable, increasing economic pressure on households. Reduced consumer spending from this pressure can slow economic growth.

Moreover, expensive housing can constrain labor mobility since workers might be either unable or reluctant to move to places where employment opportunities are high because housing there is too expensive.

This lack of mobility will lead to labor shortages in specific industries, consequently affecting productivity.

Furthermore, increasing housing prices will increase income inequality since low-income households pay more of their incomes for shelter, leaving fewer funds for other living expenses.

Interventions and Solutions to Rising House Prices in Winnipeg

To meet increasing housing prices and increase the affordable housing supply, the City of Winnipeg has launched specific funding initiatives to boost the supply of housing and assist developers who are dedicated to affordability.

The Affordable Housing Now Program aims to assist developers through the provision of financial aid in the form of Tax Increment Financing (TIF) Grants and Capital Grants.

TIF Grants provide funding for up to 80% of incremental municipal property taxes within a specified timeframe, allowing developers to recover costs and encourage affordable housing construction.

Besides tax incentives, the program also offers Capital Grants for projects above minimum affordability standards. These grants provide a maximum of $10,000 per affordable unit, with a maximum grant of $250,000 per project.

Winnipeg is also a partner in the Housing Accelerator Fund (HAF), a federal program that seeks to boost the housing supply through funding and expedited development procedures.

The city has pledged to develop 14,101 new housing units by 2027, with a minimum of 931 set aside as affordable housing.

In support of this objective, Winnipeg was awarded a $30.6 million payment in January 2025, one installment in a total $122.4 million pledge by the federal government.

The Future of Real Estate in Winnipeg

Winnipeg’s housing market is anticipated to see sustained price growth in addition to sustained affordability issues.

With the average home price in January 2025 hitting $357,708, up 0.3% year-over-year, increasing demand and scarce supply may propel further growth.

Initiatives to increase housing supply, such as the Affordable Housing Now Program and the Housing Accelerator Fund, will be instrumental in determining the market.

With Winnipeg pledged to develop 14,101 new homes by 2027, of which 931 will be affordable, such projects could assist in stabilizing house prices and making homes more accessible in the long run.

As Winnipeg’s population expands and housing demand grows, the effectiveness of affordability programs and new-home developments will play a determining role in whether or not the future market is stable.

References

- WOWA. (2025). Winnipeg housing market trends and forecasts. WOWA. https://wowa.ca/winnipeg-housing-market

- Statistics Canada. (2024, October 25). Housing market trends and affordability in Canada. Government of Canada. https://www150.statcan.gc.ca/n1/daily-quotidien/241025/dq241025c-eng.htm

- Winnipeg Regional Real Estate Board. (2025). Market statistics: Winnipeg real estate trends. https://www.winnipegregionalrealestateboard.ca/market-statistics

- End Homelessness Winnipeg. (2024). 2024 Winnipeg street census. https://endhomelessnesswinnipeg.ca/street-census/

- Nesto. (2025). Winnipeg housing market outlook: Forecast and analysis. https://www.nesto.ca/home-buying/winnipeg-housing-market-outlook/

- Financial Post. (2025). High home prices sapping Canada’s productivity: CMHC report. https://financialpost.com/news/high-home-prices-sapping-canada-productivity-cmhc#:~:text=This%20in%20turn%20hampers%20productivity,number%20of%20people%20moving%20there.&text=Take%20Toronto%20for%20example

- City of Winnipeg. (2025). Housing and development initiatives in Winnipeg. https://www.winnipeg.ca/